This article summarizes strategies to protect your assets from inflation, where prices of goods rise and the value of money decreases.

The average inflation rate in the U.S. over the past 100 years has been around 3%, but there are concerns that inflation may accelerate further in the coming years.

As inflation erodes the value of money, the real value of your assets decreases over time.

In this article, we’ll introduce investment strategies using gold, Bitcoin, stocks, and bonds to hedge against inflation.

- Inflation erodes the value of cash

- Investing in stocks, gold, Bitcoin, and bonds can help protect your assets

- Choose the right strategy based on your risk tolerance and investment goals

もくじ

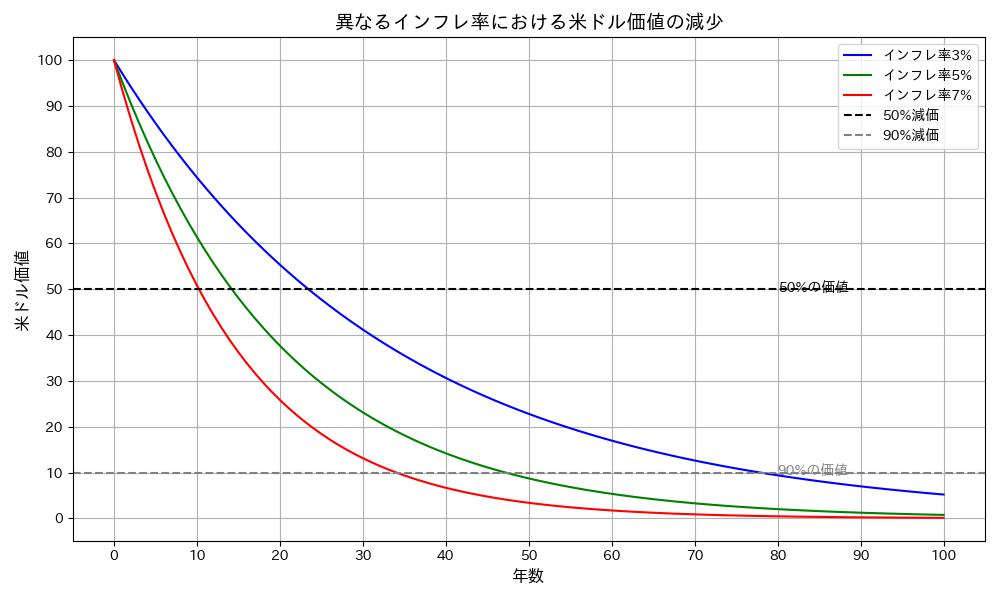

How Much Will the U.S. Dollar Devalue as Inflation Rises?

| Inflation Rate | Time Until Value Halves | Time Until 90% Decline |

|---|---|---|

| 3% | About 23 years | About 76 years |

| 5% | About 14 years | About 45 years |

| 7% | About 10 years | About 32 years |

For example, with a 7% inflation rate, the value of money halves in just 10 years.

In 1729, Voltaire warned, “All paper money eventually returns to its intrinsic value—zero.” This statement reflects the risk of inflation eroding the value of currencies due to overprinting.

For more information, see Ray Dalio’s book “Principles for Navigating Big Debt Crises.”

U.S. Inflation Trends Over the Last Century

1. Average Inflation Rate Over the Past 100 Years

The average inflation rate in the U.S. over the past 100 years is approximately 3%.

However, between 2021 and 2023, U.S. inflation spiked to an average of around 5.6%.

This was largely due to massive monetary stimulus from central banks in response to the COVID-19 pandemic.

2. Potential for Further Inflation Acceleration

The possibility of inflation rates rising to 5% or 7% is fueled by supply chain disruptions, surging energy prices, geopolitical risks, and expansive fiscal policies.

Additionally, recent trends such as the rise of BRICS nations, increased U.S. debt issuance, and the expanding debt-to-GDP ratio all contribute to heightened inflation risks.

Source: Nikkei – U.S. Debt to Hit Record High by 2029

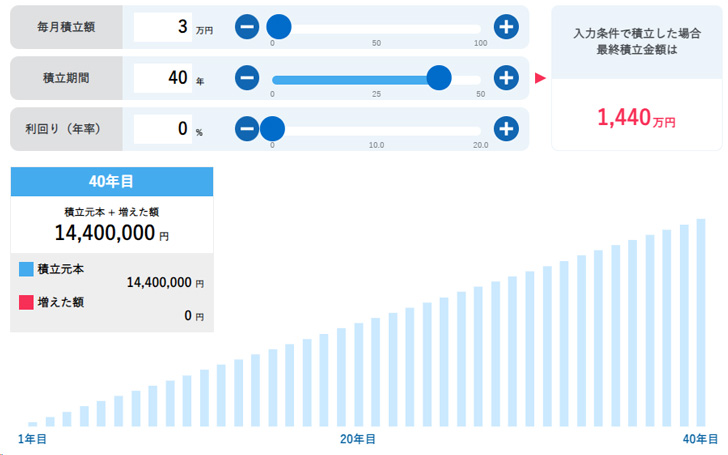

How a $300 Monthly Savings vs. Stock Investment Grows Over 40 Years

Will simply saving $300 a month protect you from inflation?

Let’s compare saving $300 per month versus investing in stocks (S&P 500) over 40 years.

1. Cash Savings: Value Drops to One-Third Over 40 Years

Even if you save $1.44 million over 40 years, with 3% inflation, its real value would only be about $480,000.

The purchasing power of the money you saved would shrink to just one-third of what it could buy 40 years earlier.

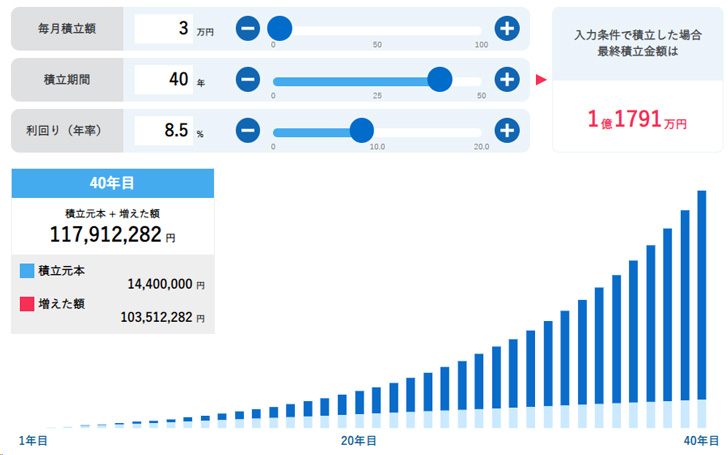

2. Stock Investment: Your Wealth Grows 8.1 Times

By investing the same $300 in the stock market (S&P 500) with an average 8.5% annual return, your investment could grow to about $11.79 million over 40 years.

Even after accounting for inflation, it would be worth about $3.93 million, which is 8.1 times more than cash savings.

Investing is Essential to Beat Inflation

While investing carries risks, if you aim to grow your wealth long-term, consider exploring tax-advantaged accounts like a Roth IRA or 401(k) and making consistent investments.

Inflation Hedge: 5 Investment Strategies to Protect Your Wealth

During periods of inflation, protecting the real value of your assets is crucial. Here, we’ll explain the key features of stocks, gold, Bitcoin, and bonds as inflation hedges and examine the pros and cons of each option.

1. S&P 500: Diversified Investment in 500 Large U.S. Companies

The S&P 500 is a mutual fund that provides diversified investment in 500 major U.S. companies.

It has achieved an average annual growth rate of 12.3% over the past 20 years.

Furthermore, in about 74% of the past 90 years, the S&P 500 has delivered positive returns, making it a reliable long-term investment.

Legendary investor Warren Buffett has consistently recommended investing in the S&P 500.

Why Stocks Help Hedge Against Inflation

As prices rise during inflation, companies can increase the prices of their goods and services.

This can boost their revenues and profits, potentially driving up stock prices.

Because the S&P 500 consists of leading U.S. companies, it’s well-positioned to benefit from inflationary conditions and even profit from price increases.

Risk of 50% or Greater Decline

The S&P 500 index experienced a continuous decline from October 9, 2007, to March 9, 2009, dropping by 56.8% over about 17 months.

It took about 4 years and 1 month, until March 28, 2013, for the index to recover to its previous high, highlighting the potential for long recovery periods.

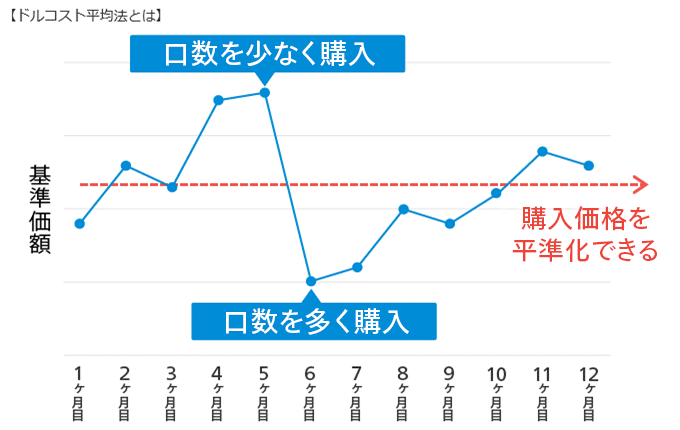

Dollar-Cost Averaging During Downturns Is Key to Success

Source: Monex Securities – The Power of Continued Dollar-Cost Averaging

Continuing to invest during market downturns is essential for long-term success.

When prices are down, you can buy more shares with the same amount of money, giving you a greater opportunity to profit when prices rebound.

By staying the course during tough times, you can position yourself for long-term success.

Global Economic Growth and U.S. Corporate Benefits

As the global economy grows, U.S. tech companies providing global services stand to benefit significantly.

For example, as developing countries like India experience economic growth, services from U.S. companies like OpenAI, Google, Amazon, and VISA will be indispensable.

Thus, global economic growth fuels the growth of U.S. companies within the S&P 500, further driving the index’s performance.

2. FANG+: Focused Investment in U.S. Tech Giants

FANG+ is an index focused on major U.S. tech giants (Facebook, Amazon, Netflix, Google, etc.).

These companies are expected to continue their rapid growth, but they also come with high volatility, making short-term swings more frequent.

FANG+: High Growth Potential

FANG+ has delivered an average annual return of 29% over the past decade, far exceeding the S&P 500’s average return of 12.3%.

This highlights the significant role U.S. tech companies have played in driving the U.S. economy.

If you believe in the future of AI and technology, FANG+ is a strong investment option.

Additionally, FANG+ is also eligible for Roth IRAs and 401(k)s, providing tax advantages for long-term investors.

High Risk

While FANG+ offers strong growth potential, it also carries significant downside risks.

During the 2008 financial crisis, the NASDAQ index, which includes many FANG+ stocks, fell by 56%.

Possibility of Slower Growth

Given their large market caps, it’s uncertain whether these companies can maintain the same level of growth going forward.

When investing, carefully consider your risk tolerance and make informed decisions.

3. Gold: A Safe Haven Asset for Inflation Protection

Gold is a safe haven asset that shines during times of economic or political instability, inflation, or currency crises.

In 2022, following the freezing of Russia’s dollar assets, central banks worldwide increased their gold reserves.

In 2024, 29% of central banks indicated they plan to increase their gold holdings within the next year.

Source: 2024 Central Bank Gold Reserves Survey

Gold Prices Have Grown 13x Over the Past 24 Years

Gold’s average annual return over the past 20 years is 12.2%, with its price rising from 1,000 yen per gram in 2000 to 13,000 yen in 2024.

Stability During Market Crashes

During the COVID-19 pandemic, gold dropped by 15%, whereas the S&P 500 dropped by 33.9%, demonstrating its relative stability.

Gold’s Scarcity and Future Potential

Gold is a finite resource, with only about 20-30 years’ worth of mineable reserves remaining. Currently, about 80% of global gold has already been extracted, increasing its rarity.

Source: How Much Gold Is Left to Mine? – BBC

4. Bitcoin: The Digital Gold

Bitcoin, launched in 2009, is the world’s first decentralized digital currency, operating independently of central banks and governments.

Its finite supply and high scarcity have earned it the nickname “digital gold,” making it a popular long-term asset.

Bitcoin Has Grown 150x in the Past 8 Years

Bitcoin surged from around $500 in 2016 to approximately $70,000 in September 2024, marking a 150x growth.

Further gains are anticipated in the coming years.

Bitcoin During Market Crashes

Bitcoin tends to crash sharply when markets panic.

During the 2020 COVID-19 crash, it plummeted 52% in just two days.

It has experienced both a 5,500% rise and a 94% crash within the same year in the past.

For Bitcoin investments, consider keeping your exposure to under 5% of your portfolio and balancing it with lower-risk assets in a “barbell strategy.”

Bitcoin’s Scarcity and Future Potential

Like gold, Bitcoin has a maximum supply of 21 million coins, which increases its long-term value potential.

As of September 2024, approximately 90% of the 21 million Bitcoin supply has been mined, further increasing its rarity.

Bitcoin is also expected to gain broader adoption as a global digital currency and payment system.

5. Bonds: A Stable Option for Risk-Averse Investors

Bonds are essentially IOUs issued by governments or companies to raise capital. When you buy a bond, you lend money in exchange for interest payments.

Bonds are generally less risky than stocks and offer more stable returns. They also tend to have an inverse relationship with the stock market, making them a valuable tool for portfolio diversification.

Inverse Relationship with Stock Market: A Hedge Against Risk

Bond prices generally have an inverse relationship with stocks. When the stock market is doing well, investors are willing to take more risks, and the demand for bonds falls, causing their prices to drop. Conversely, when the stock market underperforms, demand for the safety of bonds rises, pushing their prices up.

This inverse relationshiphelps reduce overall portfolio risk and provides more stable returns.

For example, during a stock market crash, you could sell high-priced bonds and buy more shares at a discount, aiming for significant profits through a “total return strategy.”

Renowned investor Ray Dalio advocates for the All Weather Strategy, which combines stocks, bonds, and gold to generate stable returns in any economic environment.

Types of Bonds and Risks

Bonds come in various forms, including government bonds, corporate bonds, and municipal bonds.

Bonds are also rated based on the issuer’s creditworthiness, with lower-rated bonds carrying higher risk.

While bonds are generally considered more stable than stocks, long-term bonds or low-rated bonds (junk bonds) can be highly volatile, so caution is necessary.

- Government Bonds: Issued by the government. The safest bonds but usually with lower yields. U.S. Treasuries are particularly safe.

- Corporate Bonds: Issued by companies. Higher yields than government bonds but with a higher risk of default if the company’s performance declines.

- Municipal Bonds: Issued by local governments. These are very safe and sometimes come with tax advantages.

| Asset Class | Recommended Bond Investments |

|---|---|

| U.S. Short-Term Treasury ETF (1-3 Years) | VGSH |

| U.S. Mid-Term Treasury ETF (3-10 Years) | VGIT |

| U.S. Long-Term Treasury ETF (20-30 Years) | EDV |

| U.S. Total Bond Market | BND |

| Inflation-Protected Bonds | TIP |

| U.S. BDC Funds | MAIN |

U.S. BDC Funds invest in high-growth startups and small businesses, lending them capital and distributing interest income to investors. These funds are legally required to return at least 90% of their profits to investors, making them a high-dividend option. However, keep in mind they can have stock-like price fluctuations.

Bond Investment Risks: Inflation

U.S. bonds have yielded an average return of 3.8% over the past 30 years, slightly exceeding the U.S. average inflation rate of 3%. However, as inflation accelerates, bond investments carry risks.

If inflation rises and interest rates increase, bond prices tend to fall. This is due to the inverse relationship between interest rates and bond prices, where rising interest rates make existing bonds with lower yields less attractive, resulting in lower prices.

For instance, with 3% inflation, a $10,000 bond would have a real value of only $9,700 after one year. This illustrates the risk of inflation eroding both bond income and principal value.

If you expect a sharp rise in inflation, consider these strategies:

- Invest in Inflation-Protected Bonds: TIPS and other inflation-linked bonds adjust their principal and interest with inflation, reducing inflation risk.

- Invest in Short-Term Bonds: Short-term bonds are less sensitive to interest rate changes, reducing the risk of capital loss during inflationary periods.

- Invest in High-Quality Bonds: Bonds with higher credit ratings are less likely to default, even in inflationary environments where companies might struggle.

Conclusion: Investment Strategies to Protect Against Inflation

While the average inflation rate in the U.S. has been 3% over the past century, there are growing concerns about accelerating inflation.

Understanding inflation risks and taking early action is crucial. First, clarify your investment goals and risk tolerance, and choose the right investment strategy.

This article introduced the characteristics of major asset classes like stocks (S&P 500, FANG+), gold, Bitcoin, and bonds, and their effectiveness as inflation hedges.

Each asset class has its own advantages and risks:

- Stocks (S&P 500) offer high long-term returns but come with short-term risks.

- Stocks (FANG+) offer even higher growth potential but carry greater risks than the S&P 500.

- Gold has a proven track record as a stable inflation hedge.

- Bitcoin offers high growth potential but is highly volatile. It has experienced both a 5,500% rise and a 90% drop in the past.

- Bonds are less risky than stocks and offer stability, but during periods of high inflation, their real returns could be negative.

The ideal investment strategy depends on each investor’s risk tolerance and investment goals.

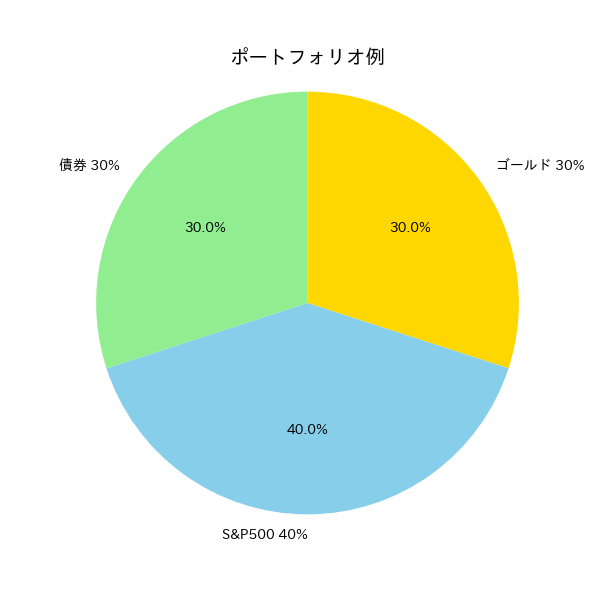

- If you have a low-risk tolerance: A portfolio with 40% stocks (S&P 500), 30% gold (GLDM), and 30% bonds (VGIT) might be suitable.

- If you want to aim for high returns: A portfolio with 90% stocks (FANG+), 5% gold (GLDM), and 5% Bitcoin could be a more aggressive approach.

Diversification, as the saying goes, “Don’t put all your eggs in one basket”, is a method of spreading investments across multiple assets to reduce risk.

If you concentrate your investments in a single asset, a sharp decline in that asset could lead to significant losses.

However, by diversifying, you increase the likelihood that other assets can offset losses from one declining asset.

Diversification is effective for reducing risk, but it doesn’t necessarily maximize returns.

Invest for the long term, without getting caught up in short-term market movements, and steadily grow your wealth.

コメントする