If you’re new to investing, you might wonder which strategy is more effective for long-term success: regular contributions (Dollar-Cost Averaging) or buying only during market downturns (Buying the Dip)?

This article explains the pros and cons of both strategies, using a 40-year S&P 500 simulation to help you make an informed choice.

- Regular contributions outperform buying during market drops over the long term.

- Investing consistently without trying to time the market is more advantageous.

- “You shouldn’t try to time the market.”

もくじ

Comparison: Dollar-Cost Averaging vs. Buying the Dip – Which Is More Profitable?

Both Dollar-Cost Averaging (DCA), where you invest a fixed amount regularly, and Buying the Dip, where you invest only when the market drops, are popular strategies for investors.

However, to determine which strategy offers better long-term results, it’s essential to evaluate the risks and returns of each. This article breaks down the differences between the two, their advantages and disadvantages, and compares the results of a 40-year S&P 500 simulation to see which approach is more effective.

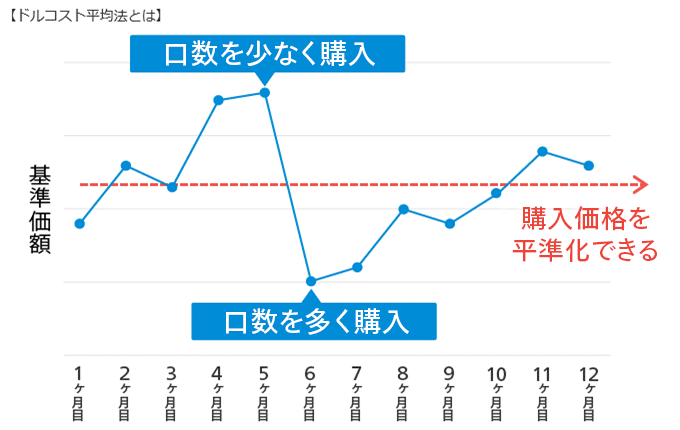

What Is Dollar-Cost Averaging (DCA)?

Originally from: Monex Securities

Dollar-Cost Averaging (DCA) involves investing a fixed amount regularly, regardless of market conditions. This strategy averages the cost of your investments over time, reducing risk and allowing for more predictable returns, especially in a rising market.

In tax-advantaged accounts like Roth IRAs or 401(k)s, regular contributions naturally follow this approach, encouraging consistent investing for long-term growth.

Advantages of DCA:

- You don’t need to worry about market timing.

- It maximizes returns by participating in overall market growth over time.

- It helps spread risk by averaging investment costs.

Disadvantages of DCA:

- During sudden market downturns, returns might decrease.

- In a quickly rising market, you may miss out on larger gains.

What Is Buying the Dip?

Buying the Dip means investing only when the market drops by a certain percentage (e.g., 5% or 10%). This strategy aims to take advantage of lower prices but comes with the risk of having cash idle while waiting for the market to decline.

Advantages of Buying the Dip:

- You can purchase assets at a discount when the market drops.

- It can be highly profitable during volatile market conditions.

- You risk missing opportunities if the market keeps rising without significant drops.

- If you mistime the market, your returns could suffer.

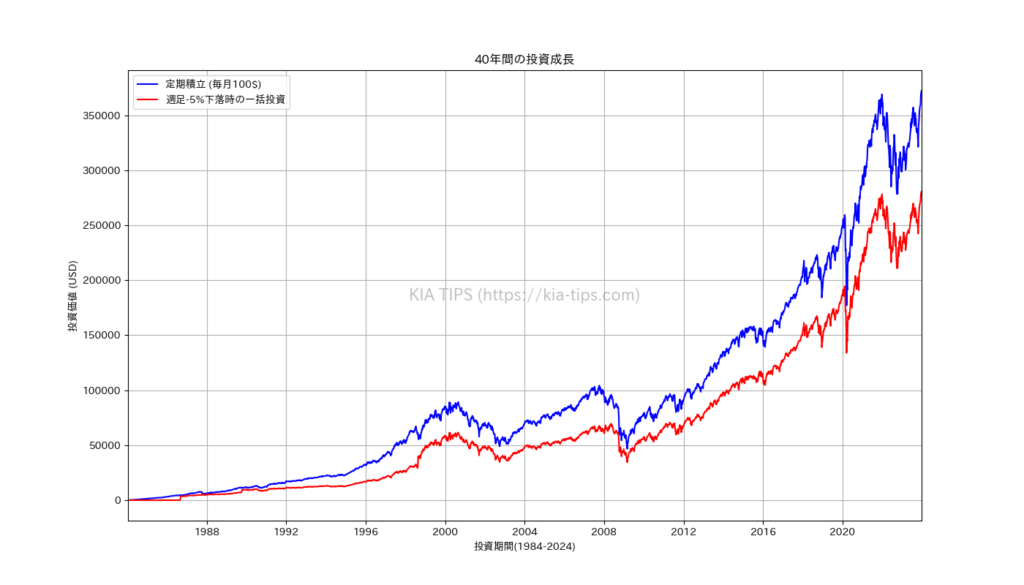

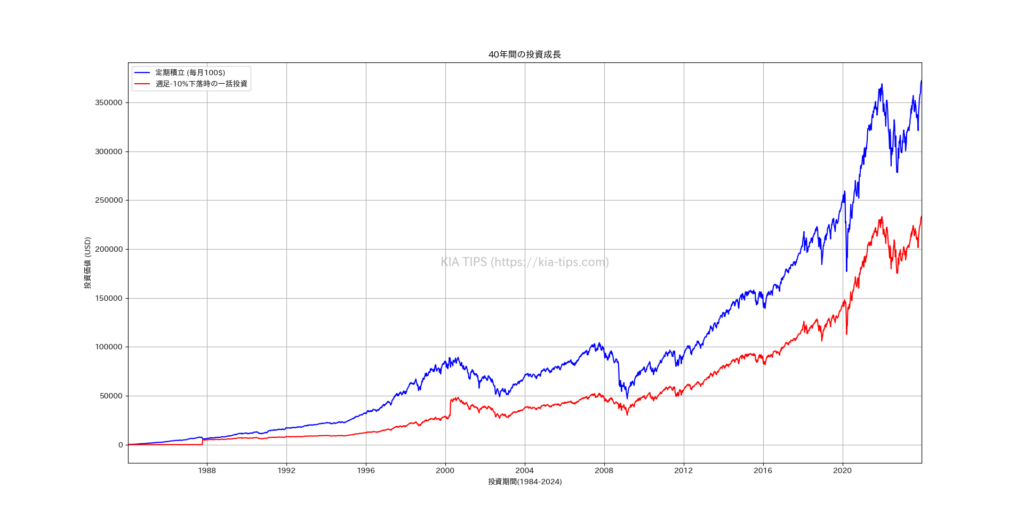

S&P 500 Simulation: DCA vs. Buying the Dip Over 40 Years

| Strategy | Total Principal (USD) | Total Returns (USD) | Return on Investment |

|---|---|---|---|

| DCA (Dollar-Cost Averaging) | $52,100 | $372,400 | +614.78% |

| 5% Dip Buying | $50,100 | $280,863 | +460.61% |

| 10% Dip Buying | $47,200 | $233,426 | +394.55% |

This table shows the simulated results of investing in the S&P 500 over a 40-year period (1983–2023). It compares the final portfolio values of DCA (monthly $100) and Buying the Dip strategies (buying after a 5% or 10% weekly market drop).

Additional Notes:

- DCA: Invests $100 monthly in the S&P 500.

- Buying the Dip: Pools cash until the S&P 500 drops 5% or 10% weekly, then invests the accumulated amount.

The simulation reveals that DCA outperformed Buying the Dip in the long run. This is because investing consistently benefits from the overall growth of the market, rather than waiting for a downturn.

While Buying the Dip can be effective during volatile periods, it carries the risk of missing opportunities when the market rises, leading to potential lost gains.

Conclusion: Dollar-Cost Averaging Wins for Long-Term Investing!

Buying the Dip can be useful for short-term volatility, but over the long term, Dollar-Cost Averaging (DCA) proves to be the more reliable strategy.

DCA’s consistent approach mitigates the risks of market timing, allowing you to take advantage of stable growth over time. As Warren Buffett famously said, “Don’t try to time the market.”

For long-term investing, consistently contributing to your portfolio is key, rather than waiting for the perfect moment.

However, the best strategy will depend on your personal investment goals and risk tolerance. Always carefully consider your options before making decisions.

Recommended Reading: JUST KEEP BUYING

- Written by Nick Maggiulli, a U.S. data scientist.

- The strategy of “Just Keep Buying” is unbeatable.

- Even the best investors can’t beat Dollar-Cost Averaging.

コメントする